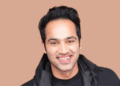

Vinod Bahety, Whole Time Director and Chief Executive Officer, Ambuja Cements Limited, says record cement volumes and lower power and fuel costs supported a normalised profit after tax of ₹378 crore

Ambuja Cements Limited reported a sharp improvement in underlying operating performance for the quarter ended December 31, 2025, supported by record cement volumes, stronger realisations, and sustained cost discipline. For a like for like assessment, the company highlighted normalised profit after tax as the most relevant measure, as it excludes one time and non recurring items that distorted year on year comparisons.

On a normalised basis, Ambuja Cements posted a profit after tax of ₹378 crore in Q3 FY26, compared with ₹106 crore in Q3 FY25, translating into a year on year growth of approximately 258 percent. The improvement reflects strong operating momentum rather than exceptional or non operating income.

The quarter saw the highest ever cement volumes at 18.9 million tonnes, up 17 percent year on year. Revenue rose 20 percent year on year to ₹10,277 crore, supported by a ₹5 per bag improvement in realisations. EBITDA increased 53 percent year on year to ₹1,353 crore, while EBITDA per tonne improved to ₹718, up 31 percent year on year.

Reported profit after tax for Q3 FY26 stood at ₹367 crore. The company noted that reported PAT in the base period of Q3 FY25, at ₹2,663 crore, was materially inflated due to non recurring items, including a government grant of ₹826 crore, interest on income tax, income tax provision reversals, and other statutory adjustments. Excluding these items provides a more accurate picture of core operating performance.

Ambuja Cements continued to outperform the broader industry during the quarter, recording volume growth at twice the industry average. Higher focus on trade and premium cement contributed to better realisations, with premium cement accounting for 35 percent of trade sales and premium volumes growing 31 percent year on year.

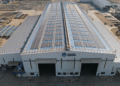

Cost leadership initiatives delivered visible gains. Kiln fuel cost declined to ₹1.65 per thousand kilocalories, among the lowest in the sector, while power cost reduced 15 percent year on year to ₹5.39 per kilowatt hour. The share of green power increased to 36.9 percent, up 14.8 percentage points year on year. Logistics cost declined to ₹1,236 per tonne, supported by higher direct dispatch and route optimisation.

Net worth stood at ₹69,854 crore at the end of the quarter. The company remained debt free and continued to maintain the highest credit ratings of AAA from CRISIL and CARE.

During the quarter, Ambuja Cements expanded its total cement capacity to 109 million tonnes per annum following the commissioning of the 2.4 MTPA Marwar Grinding Unit. The company reiterated its plan to reach 115 MTPA by March 2026, with the Warisaliganj unit now expected to be operational in Q1 FY27.

A key strategic development was the announcement of the amalgamation of ACC Limited and Orient Cement Limited with Ambuja Cements Limited, creating a unified One Cement Platform. The proposed merger is expected to optimise manufacturing and logistics, streamline operations, and improve capital efficiency, subject to regulatory approvals, with completion expected during FY27.

Commenting on the quarter, Vinod Bahety, Whole Time Director and Chief Executive Officer of Ambuja Cements Limited, said, “We continue our strong growth trajectory with record volumes and improved realisations. Cost optimisation across power, fuel, logistics, and green energy adoption remains central to our operating blueprint, alongside digitisation initiatives under CiNOC to improve productivity and efficiency.”

At Prittle PrattleNews, featuring you virtuously, we celebrate the commitment and innovation. Led by Editor-in-Chief Smruti Bhalerao, our platform is dedicated to sharing impactful stories that inspire change and create awareness. Follow us on LinkedIn, Instagram, and YouTube for more stories that matter.

1 Comment