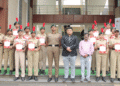

Han Tan, Chief Market Analyst at Bybit Learn, Emily Bao, Head of Spot at Bybit, and Vikas Gupta, Country Manager India at Bybit, say rising macro uncertainty and demand for gold-backed tokens have driven XAUT volumes to new peaks

Tokenized gold trading has gained momentum as macroeconomic uncertainty and rising gold prices push investors toward safe-haven assets, with Bybit emerging as the leading centralised exchange for spot trading in Tether Gold (XAUT). The exchange currently accounts for approximately 15.75 percent of total XAUT spot trading volume across centralised platforms, according to data cited from CoinGecko

The surge in trading activity coincides with XAUT reaching new all-time highs near $5,500, closely tracking spot gold prices that have crossed the $5,000 mark. Gold prices have risen amid persistent inflation risks, geopolitical tensions, central bank accumulation, and broader macroeconomic uncertainty, reinforcing gold’s role as a store of value.

Han Tan, Chief Market Analyst at Bybit Learn, said spot gold recorded its strongest annual performance in decades during 2025. He said continued central bank buying and sustained investor demand could support further upside if current macro conditions persist into 2026.

As interest in gold-backed digital assets accelerates, Bybit has become a key liquidity and price discovery venue for XAUT. Trading activity on the platform has remained active even during weekends and periods when traditional commodities markets are closed, allowing participants to gain or adjust gold exposure in real time.

The concentration of XAUT trading on Bybit reflects a broader shift in how market participants are navigating the current bull cycle. Traders are increasingly using tokenized real-world assets such as gold-backed tokens to manage volatility in digital asset portfolios while retaining the speed and accessibility of crypto markets.

Emily Bao, Head of Spot at Bybit, said the exchange’s focus has been on building deep liquidity and reliable market access to support efficient execution as tokenized gold becomes a core macro-linked asset within crypto markets.

In India, where gold has long held cultural and financial significance, interest in tokenized gold products is also growing. Vikas Gupta, Country Manager India at Bybit, said Indian traders are increasingly seeking transparent, round-the-clock access to gold exposure through digital assets, particularly amid ongoing global uncertainty.

Bybit offers multiple ways for traders to participate in the XAUT market, including spot trading, margin trading with leverage of up to ten times, and derivatives trading with leverage of up to fifty times. The platform supports XAUT deposits across several blockchains, including Solana, Ethereum, Mantle, Monad, and TON, along with automated strategies such as recurring buys and grid-based trading tools.

As the tokenized gold market expands, Bybit said it will continue to focus on liquidity depth, continuous market access, and institutional-grade infrastructure to support trading activity during the current gold-driven cycle.

At Prittle PrattleNews, featuring you virtuously, we celebrate the commitment and innovation. Led by Editor-in-Chief Smruti Bhalerao, our platform is dedicated to sharing impactful stories that inspire change and create awareness. Follow us on LinkedIn, Instagram, and YouTube for more stories that matter.

Join our affiliate community and maximize your profits—sign up now!

**back biome official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.