UGRO Capital, a data-driven lender focused on supporting India’s small businesses, has unveiled a ₹400 crore rights issue. Priced at ₹162 per share, the offering aligns with the company’s ongoing efforts to scale lending capacity and reinforce financial resilience, following its earlier ₹915 crore CCD raise.

Enhancing Shareholder Participation and Institutional Backing

The rights issue allows shareholders to subscribe to 50 new equity shares for every 189 held, with the window open from June 13 to June 20, 2025. The record date is June 5. By aligning the rights issue price with the earlier CCD issuance, UGRO signals a balanced capital strategy between public and institutional investors.

So far, UGRO has secured ₹250 crore in commitments. This includes ₹150 crore from IFU, Denmark’s government-backed investment fund, and ₹34 crore from UGRO’s promoter group and employees. The institutional support reflects confidence in the company’s credit-led growth model.

Financial Performance and Technology Integration

UGRO’s fiscal results for FY25 reinforce the logic behind the rights issue. The company reported Assets Under Management of ₹12,003 crore, reflecting a 33 percent year-on-year increase. Profit before tax rose to ₹203 crore. The company maintained a return on assets of 2.9 percent and a return on equity of 9.4 percent. Earnings per share stood at ₹15.7, and book value per share was reported at ₹219.6【178†source】【179†source】.

These financial outcomes are driven by UGRO’s technology initiatives. The company leverages GRO Score 3.0, a statistical model used for credit scoring; GRO Chain, a supply chain finance system; and GRO Xstream, a platform facilitating co-lending. Additionally, UGRO supports MSMEs with embedded finance options delivered via its GRO X application.

Leadership Outlook

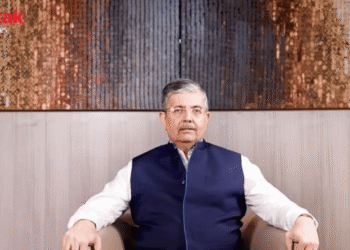

Founder and Managing Director Shachindra Nath noted that the capital raise reinforces the company’s intent to grow responsibly while allowing public shareholders a fair stake. He emphasized that this inclusive offering mirrors the pricing of preferential investors, strengthening alignment across the shareholder base.

Path Ahead and Use of Capital

The rights issue is aimed at financing the company’s expansion strategy, which includes increasing its branch footprint from 212 to 400 locations. UGRO also seeks to enhance its MSME disbursement operations and deepen its integration with embedded finance platforms. Post-fundraise, the company expects to maintain a capital adequacy ratio of over 29 percent【179†source】.

Strategic Advisors

InCred Capital serves as the financial advisor, while SNG & Partners provides legal counsel for the transaction.

About UGRO Capital (NSE: UGROCAP | BSE: 511742)

UGRO Capital is a listed NBFC focused on small business financing in India. With its emphasis on data-led underwriting and a network of co-lending and fintech partners, it aims to bridge the MSME credit gap using scalable, tech-driven models. UGRO is backed by global investors including IFU, Samena Capital, and Aregence.

For more, visit www.ugrocapital.com

Published by Prittle Prattle News featuring you virtuously

Editor in Chief: Smruti Bhalerao

At Prittle Prattle News, we honor your dedication and inventiveness led by showcasing you in a positive light. Under the direction of Editor-in-Chief Smruti Bhalerao, our platform is committed to disseminating powerful narratives that raise awareness and motivate change. For more important stories, follow us on LinkedIn, Instagram, and YouTube

magnificent put up, very informative. I ponder why the opposite experts of this sector don’t understand this. You should proceed your writing. I’m sure, you’ve a great readers’ base already!

http://www.tlovertonet.com/

amei este site. Para saber mais detalhes acesse o site e descubra mais. Todas as informações contidas são informações relevantes e exclusivas. Tudo que você precisa saber está está lá.

https://buffsports.io/watch-moto-sport

incrível este conteúdo. Gostei bastante. Aproveitem e vejam este conteúdo. informações, novidades e muito mais. Não deixem de acessar para se informar mais. Obrigado a todos e até mais. 🙂

https://nflbox.me/

hello there and thank you for your information – I’ve definitely picked up something new from right here. I did however expertise a few technical issues using this website, since I experienced to reload the web site many times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and could damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my email and could look out for a lot more of your respective intriguing content. Make sure you update this again soon..

https://bienproyectado.com/

Great amazing things here. I am very glad to look your post. Thank you a lot and i am taking a look ahead to touch you. Will you please drop me a mail?

https://tfgarquitectura.com