India operations drive Q4 recovery, Poland facility ramps up as Leven and Hyderabad sites wind down

GMM Pfaudler Ltd., the global leader in corrosion-resistant technologies and equipment for chemical and pharmaceutical industries, reported consolidated revenue of ₹3,199 crore for FY25. Despite a 7 percent year-on-year decline, the company demonstrated strong recovery in India during the second half of the fiscal, ending with ₹807 crore revenue in Q4, up 9 percent from the same quarter last year.

EBITDA stood at ₹381 crore for the year, with an adjusted margin of 11.9 percent. Profit after tax, excluding exceptional items, was ₹100 crore, translating to an EPS of ₹22.99. Order intake for FY25 closed at ₹3,102 crore, while the order backlog stood at ₹1,636 crore

India Leads Q4 Growth with Strong Profitability

India operations registered ₹252 crore in revenue for Q4 FY25 and an EBITDA of ₹44 crore, achieving a margin of 17.4 percent. This performance was attributed to a favourable product mix, volume recovery, and execution of cost optimization programs. The Indian business delivered notable improvements in H2 FY25, setting a positive trend as the company enters FY26.

Opening order backlog for the India business in FY26 is ₹549 crore, 20 percent higher than last year, reinforcing demand momentum across key verticals.

Global Manufacturing Strategy and Footprint Optimization

GMM Pfaudler continued with its footprint rationalization during the year. It completed the closure of its Hyderabad facility and expects to wind down operations at its Leven, UK plant by Q2 FY26. Simultaneously, a new low-cost manufacturing unit was established in Poland, with a capacity expansion program already underway.

The company reported ₹318 crore in free cash flow for FY25, a ₹97 crore increase compared to the previous year. This reflects the benefit of capital efficiency measures and prudent working capital management.

Leadership and Strategic Appointments

To accelerate global integration and operational transformation, Mr. Gregory Gelhaus was appointed as Chief Transformation Officer during the quarter. With multi-industry experience, Gelhaus will lead structural efficiency, supply chain modernization, and cross-market synergy initiatives across the company’s international subsidiaries.

Dividend Declaration

The Board of Directors recommended a final dividend of ₹1 per equity share for FY25. Combined with the interim dividend paid earlier, the total dividend payout for the year stands at ₹2 per share, subject to shareholder approval.

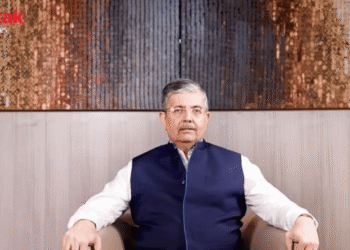

Management Commentary

Mr. Tarak Patel, Managing Director of GMM Pfaudler, said, “While FY25 presented challenges due to chemical and pharma sector slowdowns and geopolitical uncertainty, our disciplined focus on cost control and diversification helped us navigate volatility. Our India business has performed particularly well in the latter half of the year. Our global optimization program, including the setup in Poland and closures in Leven and Hyderabad, positions us for greater efficiency and margin expansion going forward.”

He added, “We are excited to welcome Greg to our leadership team. His experience will be instrumental in transforming GMM Pfaudler into a more agile and digitally integrated global manufacturing partner.”

Financial Highlights (Consolidated)

- FY25 revenue: ₹3,199 crore

- FY25 EBITDA: ₹381 crore (adjusted)

- FY25 PAT: ₹100 crore (excluding exceptional items)

- FY25 EPS: ₹22.99

- FY25 order intake: ₹3,102 crore

- FY25 closing backlog: ₹1,636 crore

- Q4 FY25 revenue: ₹807 crore

- Q4 FY25 PAT: ₹15 crore (adjusted)

- Free cash flow: ₹318 crore in FY25

Pretty part of content. I just stumbled upon your site and in accession capital to assert that I get actually enjoyed account your weblog posts. Anyway I will be subscribing in your augment or even I success you get admission to consistently fast.

http://www.tlovertonet.com/