Golden Star Resources Reports Results for the Three and Twelve Months Ended December 31, 2020 Delivering on Increased 2020 Production Guidance at Wassa

Golden Star Resources Ltd. (NYSE American: GSS) (TSX: GSC) (GSE: GSR) (“Golden Star” or the “Company”) reports its financial and operational results for the fourth quarter and full year ended December 31, 2020. All references herein to “$” are to United States dollars.

Q4 2020 AND FY 2020 HIGHLIGHTS:

- FY 2020 was a transformational year as a result of the delivery of a number of significant milestones, including: the transition of the corporate office to London, the implementation of a new management team, the sale of Bogoso-Prestea, refinancing of the Macquarie Bank credit facility (the “Macquarie Credit Facility”), delivery of increased production guidance at Wassa and completion of key infrastructure projects that are expected to support increased production rates in the future, all achieved while managing challenges posed by COVID-19.

- FY 2020 production totaled 167.6 thousand ounces (“koz”) from continuing operations (Wassa), 7% higher than in FY 2019, delivering on the increased guidance range of 165-170koz and exceeding the original guidance of 155-165koz. The $1,003/oz all-in sustaining cost (“AISC”) for the period was slightly above the $930-990/oz guidance range following the decision to process low grade stockpiles and higher royalties as a result of the increase in the gold price.

- Q4 2020 production totaled 40.9koz from continuing operations, 2% lower than Q3 2020. The $1,069/oz AISC for the period was 4% higher than the $1,023/oz achieved in Q3 2020 due to the increased investment in capitalized development in the period.

- Free cash flow from continuing operations totaled $5.9 million (“m”) in Q4 2020 and $36.8m for FY 2020, representing a $43.1m increase on FY 2019 performance.

- Cash increased by $12.5m in Q4 2020 to $60.8m at December 31, 2020, net debt reduced by $5.1m to $45m.

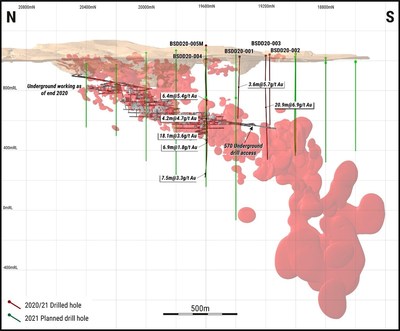

- Drilling conducted towards the end of Q4 2020 delivered positive drilling results adjacent to the B-Shoot structure, which is the current focus of the Wassa underground operation (“Wassa Underground”). These intercepts demonstrate the potential to increase the size of the Wassa ore body with extensions to the main B-Shoot, the hanging wall zone and a new foot wall target.

Table 1 – Continuing Operations Performance Summary – Three and twelve months ended December 31, 2020

|

1. See “Non-GAAP Financial Measures” |

Q4 2020 |

Q4 2019 |

% change |

FY 2020 |

FY 2019 |

% change |

|

|

Production – Wassa |

Koz |

40.9 |

41.3 |

(1)% |

167.6 |

156.2 |

7% |

|

Total gold sold |

Koz |

43.6 |

41.9 |

4% |

167.5 |

156.5 |

7% |

|

Average realized gold price |

$/oz |

1,579 |

1,278 |

24% |

1,626 |

1,302 |

25% |

|

Cash operating cost per ounce – Wassa1 |

$/oz |

680 |

615 |

11% |

653 |

633 |

3% |

|

All-in sustaining cost per ounce – Wassa1 |

$/oz |

1,069 |

968 |

10% |

1,003 |

938 |

7% |

|

Gold revenues |

$m |

68.8 |

53.6 |

28% |

272.5 |

203.8 |

34% |

|

Adj. EBITDA1 |

$m |

36.5 |

26.0 |

40% |

131.6 |

78.3 |

68% |

|

Adj. income/share attributable to shareholders – basic1 |

$/share |

0.11 |

0.07 |

57% |

0.40 |

0.16 |

150% |

|

Cash provided by continuing operations before working capital changes and tax paid |

$m |

30.9 |

19.9 |

55% |

113.5 |

58.5 |

94% |

|

Changes in working capital and tax paid |

$m |

(11.5) |

(0.7) |

(1543)% |

(29.5) |

(8.4) |

(251)% |

|

Cash outflow from investing activities |

$m |

(13.5) |

(22.9) |

41% |

(47.2) |

(56.5) |

16% |

|

Free cash flow1 |

$m |

5.9 |

(3.7) |

259% |

36.8 |

(6.4) |

675% |

|

Net cash provided by financing activities |

$m |

8.6 |

8.0 |

8% |

2.1 |

1.5 |

40% |

|

Cash |

$m |

60.8 |

53.4 |

14% |

60.8 |

53.4 |

14% |

|

Net Debt |

$m |

45.0 |

53.4 |

(16)% |

45.0 |

53.4 |

(16)% |

Table 2 – Consolidated Performance Summary – Three and twelve months ended December 31, 2020

|

1. See “Non-GAAP Financial Measures” |

Q4 2020 |

Q4 2019 |

% change |

FY 2020 |

FY 2019 |

% change |

|

|

Production – Wassa |

Koz |

40.9 |

41.3 |

(1)% |

167.6 |

156.2 |

7% |

|

Production – Prestea |

Koz |

– |

11.4 |

(100)% |

22.4 |

47.6 |

(53)% |

|

Total gold produced |

Koz |

40.9 |

52.7 |

(22)% |

190.0 |

203.8 |

(7)% |

|

Total gold sold |

Koz |

43.6 |

53.4 |

(18)% |

189.5 |

204.2 |

(7)% |

|

Average realized gold price |

$/oz |

1,579 |

1,237 |

28% |

1,627 |

1,297 |

25% |

|

Cash operating cost per ounce – Wassa1 |

$/oz |

680 |

615 |

11% |

653 |

633 |

3% |

|

Cash operating cost per ounce – Prestea1 |

$/oz |

– |

1,616 |

(100)% |

2,033 |

1,484 |

37% |

|

Cash operating cost per ounce – Consolidated1 |

$/oz |

680 |

831 |

(18)% |

813 |

832 |

(2)% |

|

All-in sustaining cost per ounce – Wassa1 |

$/oz |

1,069 |

968 |

10% |

1,003 |

938 |

7% |

|

All-in sustaining cost per ounce – Prestea1 |

$/oz |

– |

2,167 |

(100)% |

2,477 |

1,885 |

31% |

|

All-in sustaining cost per ounce – Consolidated1 |

$/oz |

1,069 |

1,227 |

(13)% |

1,174 |

1,159 |

1% |

|

Gold revenues |

$m |

68.8 |

53.6 |

28% |

272.5 |

203.8 |

34% |

|

Adj. EBITDA from continuing and discontinued operations1 |

$m |

36.5 |

21.4 |

71% |

121.7 |

65.4 |

86% |

|

Adj. income/(loss)/share attributable to shareholders – basic1 |

$/share |

0.09 |

(0.03) |

400% |

(0.07) |

(0.04) |

(75)% |

|

Cash provided by operations before working capital changes and tax paid |

$m |

28.9 |

10.5 |

175% |

98.8 |

36.8 |

168% |

|

Changes in working capital |

$m |

(11.5) |

2.6 |

(542)% |

(38.7) |

(14.0) |

(176)% |

|

Cash outflow from investing activities |

$m |

(13.5) |

(25.1) |

46% |

(54.7) |

(67.4) |

19% |

|

Free cash flow1 |

$m |

4.0 |

(12.0) |

133% |

5.4 |

(44.6) |

112% |

|

Net cash provided by financing activity |

$m |

8.6 |

8.6 |

– |

2.1 |

1.4 |

50% |

|

Cash |

$m |

60.8 |

53.4 |

14% |

60.8 |

53.4 |

14% |

|

Net Debt |

$m |

45.0 |

53.4 |

(16)% |

45.0 |

53.4 |

(16)% |

Andrew Wray, Chief Executive Officer of Golden Star, commented:

“As these results demonstrate, 2020 saw a number of important achievements for our business which underpin our confidence in delivering on our longer term growth plans. The $36.8m of cash flow generation from Wassa, combined with the sale of Bogoso-Prestea and the refinancing of the Macquarie loan facility, delivered a significant improvement in our financial position. In turn, this enabled us to invest in key infrastructure necessary for the continuing growth of Wassa, including electrical upgrades, new dewatering infrastructure and a state-of-the-art paste fill plant, that positions Golden Star to realize the longer term growth potential for the Wassa operation.

The delivery of our improved production guidance range, despite the numerous challenges that arose as a result of the COVID-19 pandemic, highlights the strength of operational performance at Wassa. The AISC performance at Wassa was a little higher than guidance due to an acceleration of investment in underground development during Q4 2020, in addition to the impact of the higher than budgeted gold price and the processing of low-grade stockpiles which added $20/oz and $10/oz, respectively. This operational performance led to a Group cash position of $60.8m at the end of the quarter, an increase of $7.4m over the year, despite $31.4m of cash consumption at Bogoso-Prestea during the year.

Our 2021 production guidance is set at 165-175koz with costs expected to remain in line with recent performance. We will also maintain the level of capital spend in 2021, with a focus to increasing development and drilling activities, to support further volume increases for production growth and enhanced cash flow generation. We will share more detail on this growth opportunity in the PEA which we expect to publish as part of an updated technical report including our annual reserve and resource update on March 1, 2021.

I am particularly pleased that, as a result of our achievements during 2020, we are able to increase our exploration budget in 2021 to $15.0m. With numerous underground and surface targets, including the potential for stand-alone targets along the 90km mineralized trend to the south of Wassa, it is exciting to report that the drilling program we started in Q4 2020 is already indicating potential for extensions of the Wassa ore body around existing and planned underground infrastructure.”

FY 2020 RESULTS WEBCAST AND CONFERENCE CALL

Following the release of our FY 2020 financial statements on February 24, 2020, the Company will conduct a conference call and webcast on Thursday, February 25, 2020 at 10:00 am ET.

Toll Free (North America): +1 888 390 0546

Toronto Local and International: +1 416 764 8688

Toll Free (UK): 0800 652 2435

Conference ID: 34205106

Webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1421060&tp_key=082312cdc3

Following the conference call, a recording will be available on the Company’s website at: www.gsr.com

KEY EVENTS – FY 2020

Wassa Operational Performance and Infrastructure Investment

- Through FY 2020, the mining rate averaged 4,469 tonnes per day (“tpd”), representing a 15% increase on the 3,895tpd achieved in FY 2019. The underground mining rate has now exceeded 4,000tpd for six consecutive quarters.

- The underground mined grade increased to 3.4 grams per tonne (“g/t”), 21% higher than the 2.8g/t realized in Q3 2020. This is attributable to the normalization of the blend of the higher and lower grade mining areas. During 2020 the mined grade averaged 3.1g/t.

- Late in Q1 2020, we took the decision to selectively process some low-grade stockpiles, given the strength of the gold price. This initiative utilizes latent capacity in our process plant without compromising gold recovery rates, which contributes additional cash flow, albeit at a slightly higher AISC than achieved by the underground mine. This initiative contributed 7koz of production during FY 2020 and added approximately $10/oz to the reported AISC at site. The initiative also served to demonstrate the available capacity of the processing plant. Throughput rates averaged 5,509tpd through FY 2020, and exceeded 6,000tpd during Q3 2020.

- Investment in the infrastructure required to provide additional mining flexibility and support the ambition to increase mining rates continued throughout FY 2020. Capital expenditure totaled $45.2m during FY 2020; this included $12.1m on the paste fill plant project which reached construction completion at the end of December. The project is expected to commission during Q1 2021 and is tracking to a total cost of $19m, approximately 10% below budget.

Wassa Preliminary Economic Assessment

- Work on a preliminary economic assessment (“PEA”) on the development of the Southern Extension of the Wassa ore body commenced during Q3 2020. The study is intended to lay out a roadmap for the infrastructure and investment required for the potential expansion of the mining operation into the inferred resource areas. The PEA will be included in an updated technical report with the updated mineral reserve and resource estimate for Wassa, prepared in accordance with NI 43-101.

- The technical report is expected to be released on the morning of Monday, March 1, 2021 and immediately following the release of the report, the Company will conduct a conference call and webcast at 09.00 am ET on the same day:

Toll Free (North America): +1 888 390 0546

Toronto Local and International: +1 416 764 8688

Toll Free (UK): 0800 652 2435

Conference ID: 07861267

Webcast: https://produceredition.webcasts.com/starthere.jsp?ei=1433535&tp_key=0dc82839cc

Following the conference call, a recording will be available on the Company’s website at: www.gsr.com.

COVID-19 PANDEMIC

- During 2020, our operations in Ghana experienced 320 personnel that presented with symptoms or volunteered for COVID-19 testing with 63 confirmed cases including Bogoso-Prestea employees until the time of completion of the sale of the Bogoso-Prestea operations to Future Global Resources. The Company’s in-house Polymerase Chain Reaction (“PCR”) testing capability allows for rapid diagnosis and management response. This significantly reduced the number of people required to isolate as a result of contact tracing, supporting business continuity throughout the pandemic. As a major employer and therefore catalyst for rural economic stimulus in the host communities, we understand that our continuing operations are critical to the health and well-being of our workforce and the thousands of people that they support, both directly and indirectly. Given the relatively low number of confirmed and suspected COVID-19 cases, the operational impact during 2020 was limited. As at December 31, 2020, there were zero suspected or confirmed COVID-19 cases in our workforce, which had been the status for the entire month of December 2020. During the course of the year, six personnel from the Wassa operations were admitted to hospital for COVID-19 case management and all have recovered. More information on our COVID-19 management controls can be found at www.gsr.com/responsibility/COVID-19

- Supply chain – Supply chains for the key consumables, including cyanide, lime, grinding media, fuel and lubricants, have remained intact throughout the pandemic. All supply chains are being continually monitored and alternative suppliers have been identified for essential supply chains.

- Gold sales – The cessation of commercial flights resulting from the pandemic in March 2020 created a need to implement alternative logistics for transporting doré to refining facilities in South Africa. The alternative arrangements were in place from the end of Q1 2020 to Q3 2020, enabling exports to continue throughout FY 2020. Limited commercial flights resumed during Q3 2020 and continued throughout Q4 2020. During Q4 2020 sales were able to align with production, therefore catching up on the delayed sales caused by the cessation of commercial flights earlier in the year.

Safety and Health

- For continuing operations, the all-injury frequency rate (AIFR) as at December 31, 2020 was 2.57 and the total recordable injury frequency rate (TRIFR) was 0.34, based on a 12-month rolling average per million hours worked. This compares favorably to the continuing operations AIFR of 4.23 and TRIFR of 0.53 at December 31, 2019.

- The improved safety performance at Wassa also compares favorably to the historical data including discontinued operations given the improvement over the December 31, 2019 AIFR of 8.75 and TRIFR of 1.79, reflecting the change in risk profile for the Company following the sale of the Bogoso-Prestea operation.

- Despite the improvement in injury frequency rates, 2020 was marred by a fatal incident at Prestea in March 2020, when an employee was tragically killed in a derailment incident. Corrective actions to prevent a recurrence were implemented at the operations and incorporated findings of the investigation by the Ghanaian Inspectorate Division of the Minerals Commission. This tragic incident reinforced our deeply held belief that everyone must go home safely every day and with this intent, the Company continued the implementation of its safety strategy, with a focus on critical risk controls, throughout the year.

- In November 2020, Golden Star Wassa was announced as the Best Performer in Occupational Health and Safety at the annual Ghana Mining Industry Awards for the second year in succession and for the third time in the last four years.

Upsizing of Senior Secured Credit Facility – October 8, 2020

- A key strategic objective for the Company in 2020 was to reposition the balance sheet to improve liquidity and provide the platform for future investment in growth. On October 8, 2020, the Company delivered a significant milestone in this regard with the completion of the amendment and upsizing of the Macquarie Credit Facility. The full detail on the amendment of the Credit Facility can be found in the press release dated October 9, 2020.

- The Macquarie Credit Facility has been increased to $70 million, allowing the Company to re-draw the two $5 million principle repayments that were made in June and September 2020 and an additional $10 million of new capacity which will be made available in conjunction with the redemption of the convertible debentures maturing in August 2021. This represents a $20 million increase on the $50 million outstanding balance on the Macquarie Credit Facility at September 30, 2020.

- The Macquarie Credit Facility had been amortizing at a rate of $5 million per quarter with two principal repayments made as at September 30, 2020. The restructuring of the Macquarie Credit Facility includes a rescheduled amortization profile which defers the next quarterly principle repayment to September 2021. These quarterly principle repayments will then continue to December 2023 when the remaining balance of the facility will be settled by a $25 million bullet payment.

- The restructuring of the Macquarie Credit Facility creates $35 million of incremental liquidity which, combined with the $15 million of proceeds from the sale of the Bogoso-Prestea operations due to be received by July 2021, results in $50 million of additional liquidity.

Corporate Relocation

- During H1 2020, the corporate office moved to London, UK, from Toronto, Canada, following a new management team being assembled at the start of the year. This brings the corporate team into the same time zone as the operation and reduces the travel time to West Africa to enable more direct support of the mine site management.

At the Market Equity Program

- On October 28, 2020, the Company entered into a sales agreement relating to a $50 million “at the market” equity program. The use of proceeds from the “at the market” equity program are for discretionary growth capital at Wassa, exploration, general corporate purposes and working capital. As at February 24, 2021, no shares had been sold under the “at the market” equity program.

RECENT EVENTS – Post FY 2020 period end

Severance Claim

- On September 15, 2020, certain employees of Golden Star (Bogoso/Prestea) Limited (“GSBPL”) initiated proceedings before the courts in Ghana, claiming that the completion of the sale of the Bogoso-Prestea operations would trigger the termination of their employments, entitling them to severance payments. GSBPL retained defense legal counsel to defend the claim given no employment contracts were severed, amended or modified as a result of the sale transaction which completed on September 30, 2020, and filed an application in court for an order striking out the plaintiffs’ statement of claim for lack of standing or capacity and disclosing no reasonable cause of action. On February 16, 2021, the court ruled in favor of GSBPL. In accordance with applicable laws, the plaintiffs have three months from the date of the ruling to file an appeal.

2020 PRODUCTION, COST AND CAPITAL EXPENDITURE GUIDANCE

Table 3 – Q4 2020 and FY 2020 Performance Versus Guidance

|

Q4 2020 |

FY 2020 |

Updated |

Original |

||||

|

Production and cost highlights |

|||||||

|

Production – Wassa |

koz |

40.9 |

167.6 |

165-170 |

155-165 |

||

|

Production – Prestea |

koz |

– |

22.4 |

22.3 |

40-45 |

||

|

Total gold produced |

koz |

40.9 |

190.0 |

187-192 |

195-210 |

||

|

Cash operating cost per ounce – Wassa1 |

$/oz |

680 |

653 |

620-660 |

620-660 |

||

|

Cash operating cost per ounce – Prestea1 |

$/oz |

– |

2,033 |

2,033 |

1,400-1,550 |

||

|

Cash operating cost per ounce – Consolidated1 |

$/oz |

680 |

813 |

810-850 |

790-850 |

||

|

All-In Sustaining cost per ounce – Wassa1 |

$/oz |

1,069 |

1,003 |

930-990 |

930-990 |

||

|

All-In Sustaining cost per ounce – Prestea1 |

$/oz |

– |

2,477 |

2,477 |

1,650-1,850 |

||

|

All-In Sustaining cost per ounce – Consolidated1 |

$/oz |

1,069 |

1,174 |

1,100-1,180 |

1,080-1,180 |

||

|

Capital Expenditure |

|||||||

|

Sustaining Capital – Wassa |

$m |

8.6 |

24.7 |

20-22 |

23-25 |

||

|

Sustaining Capital – Prestea |

$m |

– |

5.4 |

5.4 |

6.5-7.5 |

||

|

Sustaining Capital – Corporate |

$m |

(0.3) |

0.1 |

– |

– |

||

|

Sustaining Capital – Consolidated |

$m |

8.3 |

30.2 |

25.4-27.4 |

29.5-32.5 |

||

|

Expansion Capital – Wassa2 |

$m |

5.4 |

19.0 |

18-20 |

19-21 |

||

|

Expansion Capital – Prestea2 |

$m |

– |

1.6 |

1.6 |

2.5-3 |

||

|

Expansion Capital – Capitalized Exploration2 |

$m |

1.1 |

1.5 |

2.5 |

3.5 |

||

|

Expansion Capital – Consolidated2 |

$m |

6.5 |

22.1 |

22.1-24.1 |

25-27.5 |

||

|

Total Capital – Wassa3 |

$m |

14.0 |

43.7 |

38-42 |

42-46 |

||

|

Total Capital – Prestea3 |

$m |

– |

7.0 |

7.0 |

9-10.5 |

||

|

Total Capital – Capitalized Exploration3 |

$m |

1.1 |

1.5 |

2.5 |

3.5 |

||

|

Total Capital – Corporate3 |

$m |

(0.3) |

0.1 |

– |

– |

||

|

Total Capital – Consolidated 3 |

$m |

14.8 |

52.2 |

47.5-51.5 |

55-60 |

|

Notes: |

|

1. See “Non-GAAP Financial Measures” |

|

2. Expansion capital are those costs incurred at new operations and costs related to major projects at existing operations where these projects are expected to materially increase production. All other costs relating to existing operations are considered sustaining capital. |

|

3. Excludes all non-cash capital additions, including right-to-use assets under financial leases |

Production

- Wassa. The guidance for Wassa was increased from 155-165koz to 165-170koz during the year. Following consistent performance from the underground mine and the additional production generated by the processing of low-grade stockpiles, the operation was able to deliver on the increased guidance range.

- Consolidated. Group production, including discontinued operations, totaled 190koz, in line with the 187-192koz guidance range.

Cash operating costs

- Wassa. Cash operating cost performance fell in the upper half of the $620-660/oz guidance range for Wassa, mainly due to the processing of low-grade stockpiles, higher gold transport costs following the use of private charters due to the disruption of commercial flights caused by the COVID-19 pandemic and higher processing volumes. The low-grade stockpile initiative successfully generated incremental production and cash while adding $10/oz to the unit costs given the lower grade of the material processed.

- Consolidated. The group cash operating costs, including discontinued operations, totaled $813/oz, in line with the lower end of the $810-850/oz guidance range.

AISC

- Wassa. AISC for Wassa tracked towards the upper end of the $930-990/oz AISC guidance range throughout FY 2020 and ended the year slightly exceeding the guidance range as a result of:

- The $10/oz increase in the cash operating costs resulting from the processing of low grade stockpiles;

- The impact of higher gold prices driving higher royalty payments to the Government of Ghana. This equates to a $20/oz increase in the AISC in YTD 2020 over budgeted levels;

- The restatement of the AISC performance for the year to date to fully allocate the general and administrative (“G&A”) expense to continuing operations, reallocating the G&A that was previously ascribed to Prestea to Wassa.

- Consolidated. The group AISC, including discontinued operations, was $1,174/oz in FY 2020. In line with the $1,100-1,180/oz guidance range.

Capital expenditure

- Wassa. The improved financial position of the business and the sustained increase in the gold price allowed the Company to increase its investment in capital during Q4 2020. As a result, Wassa exceeded the revised capital guidance of $38–42m. Capital expenditure totaled $45.2m during FY 2020, in line with the initial guidance range.

- Consolidated. As a result of the increase in capital investment at Wassa during Q4 2020, the consolidated capital expenditure totaled $52.2m, slightly exceeding the $47.5–51.5m guidance range.

FY 2021 PRODUCTION AND COST GUIDANCE

Table 4: FY 2021 Production and Cost Guidance

|

2021 Guidance |

2020 Guidance |

|

|

Gold Production (koz) – Wassa |

165-175 |

165-170 |

|

Cash Operating cost1 ($/oz) – Wassa |

660-700 |

620-660 |

|

AISC1 ($/oz) – Wassa |

1,000-1,075 |

930-990 |

|

Notes: |

|

1. See “Non-GAAP Financial Measures”. |

FY 2021 Production Guidance

Wassa is expected to produce between 165-175koz ounces in 2021. This is in line with the 2020 production performance, which benefited from an increase in the underground mining rates and an estimated 7koz of production from the processing of low-grade stockpiles. The contribution from stockpiles is expected to continue throughout 2021 with a little under 1,000tpd of stockpiled material expected to be processed at a grade of approximately 0.6g/t. This initiative remains subject to gold prices sustaining near current levels.

We expect mining rates for 2021 to be in excess of 4,500tpd, in line with the 4,469tpd achieved in 2020. The investment in drilling and development in 2020 will unlock further increases in the mining rates in the future. Underground mined grades are expected to remain in line with the average grade achieved in 2020. The infill drilling program continued to progress during 2020, and as a result 80% of the 2021 mine plan comprises of ounces from the measured resource category.

We are currently finalizing our reserve and resource calculations for year end 2020 and the PEA. As part of this process, we will be reviewing the mine plan and future grade profile at Wassa. This work includes an update of the modifying factors in mine plans for recent stope performance and an optimized cut-off grade.

Cost Guidance

The $660/oz to $700/oz cash operating cost guidance for 2021 shows a slight increase over 2020 due to the planned commissioning of the paste fill plant in Q1 2021. The plant will add $5 to $7 per tonne to the mining cost once operational and this cost will be offset by the benefits associated with an increase in the recovery of the ore body.

The 2021 AISC guidance at Wassa increases relative to 2020 due to the continued investment in underground development which is reflected in higher sustaining capital partly offset by reduced power cost from Genser Energy (“Genser”) as discussed in table 5.

The continuation of the processing of low-grade stockpiles in FY 2021 will include the material from the Skyway stockpile during the second half of 2021 which is held in inventory and will result in a non-cash cost as the material is drawn down, adding $15/oz (non-cash) to the overall AISC. This is in addition to the incremental processing costs associated with the low-grade stockpile, as seen in FY 2020. The low-grade stockpiles processed during FY 2020 were not held with an inventory value and therefore had a more limited impact on the AISC.

FY 2021 CAPITAL EXPENDITURE AND EXPLORATION GUIDANCE

Table 5: FY 2021 Capital Expenditure and Exploration Guidance Summary

|

($m) |

2021 Guidance – Wassa |

2020 Guidance – Wassa3 |

|

Capital Expenditure |

||

|

Sustaining Capital2 |

26-28 |

20-22 |

|

Expansion Capital2 |

19-22 |

18-20 |

|

Total Capital Expenditure |

45-50 |

38-42 |

|

Exploration |

||

|

Total Exploration spend |

15 |

6 |

|

Notes: |

|

1. See “Non-GAAP Financial Measures”. |

|

2. Expansion capital are those costs incurred at new operations and costs related to major projects at existing operations where these projects will materially increase production. All other costs relating to existing operations are considered sustaining capital. |

|

3. The revised 2020 guidance was announced on October 28, 2020. |

Capital Expenditure Guidance

The capital programs at Wassa are expected to total $45m to $50m in 2021. This is in line with the $45.2m invested in Wassa in 2020 which focussed on major infrastructure projects. With those now complete, the investment in 2021 will focus on drilling and development. In order to ensure a robust balance sheet through the repayment of the convertible debentures in August 2021, and to allow for a ramp up in drilling and development activities, 40% of the spend is budgeted for H1 2021 and the remaining 60% during H2 2021.

Sustaining capital is expected to total $26m to $28m, of which $16m is allocated to capitalized development and $4m to $5m to the expansion of the tailing storage facilities. Expansion capital is expected to total $19m to $22m, of which $7m to $8m is allocated to capitalized drilling, $7m to ventilation infrastructure and $4m to capitalized development.

In accordance with IFRS 16 – Leases accounting standard, the completion of the construction of the Genser power plant will result in the inclusion in the consolidated financial statements of a non-cash $33.5m right-to-use asset addition to property, plant and equipment and the recognition of a corresponding lease liability during Q1 2021. An element of the cost of power supplied by the Genser plant will be accounted for as depreciation of the capital asset and as a finance cost. Approximately $20/oz of the power cost will therefore not be allocated to cash operating costs or AISC.

Exploration Budget and programs

A $15m exploration budget has been approved for 2021 of which $7m will be invested in and around the Wassa mine. This work will include the continued wide spaced drilling up and down dip of the current resources and reserves as well as drill testing of seven targets to the south and east of the Main Wassa deposit. Approximately 28,000 metres of combined diamond and reverse circulation drilling has been planned. In addition, 9,000 meters of air core drilling has been planned to test the coincidental geophysical and geochemical anomaly over the eastern fold closure target.

In addition, $6m has been allocated for further testing of the five HBB targets followed up in 2020 as well as five additional targets along the Hwini Butre-Benso (“HBB”) corridor. Approximately 50,000 meters of air core drilling will be conducted over the soil geochem anomalies defined last year and in past programs. Several of these targets will be further delineated with ground geophysics prior to drilling. Pending positive results from the air core drilling, approximately 15,000 meters of deeper reverse circulation with diamond core tails has been planned for initial follow up. Several of the historical open pits on the Benso mining lease have never had any drilling beneath them and these deposits have higher grade cores that could potentially form underground targets. In light of this 12,000 meters of reverse circulation and diamond core tails has been budgeted to test below these pits on wide spacing.

The Abura project operates under an earn-in agreement between the Company and a Ghanaian concession owner. This project is located to the South West of the HBB concessions and has been drilled with shallow rotary air blast holes which returned some positive results which require follow-up with deeper reverse circulation and diamond drilling. The 2021 budget has 5,000 metres of drilling planned with approximately $0.7m being allocated to this program.

These “regional” exploration programs have been designed to move the various prospects up the exploration pipeline, with positive results justifying further work in 2022 and beyond. Prospects which do not generate positive results will be divested or dropped.

SUMMARY OF CONSOLIDATED OPERATIONAL RESULTS – FY 2020 (including discontinued operations)

Group production totaled 40.9koz in Q4 2020, the first quarter where production was sourced entirely from Wassa following the completion of the sale of the Bogoso-Prestea operation at the end of Q3 2020. Total gold sold amounted to 43.6koz for Q4 2020. The AISC amounted to $1,069/oz for Q4 2020 which was a little higher than realized in Q3 2020 due to the acceleration in investment in capitalized development.

FY 2020 consolidated performance includes nine months of contribution from Bogoso-Prestea up to the completion of the sale of the operation at the end of Q3 2020. Group production totaled 190.0koz, which included 167.6koz from Wassa (7% increase on FY 2019) and 22.3koz from Prestea during the first nine months of the year. The consolidated AISC totaled $1,174/oz in FY 2020 compared to the $1,159/oz realized in FY 2019.

Wassa Operational Overview – continuing operations

Wassa Underground continued to operate through the challenges posed by the COVID-19 pandemic in FY 2020. In Q3 2020, the pandemic impacted on development rates as a result of the expat jumbo operators being unable to enter the country. These operators were able to return to site during Q4 2020; as a result the development rates were accelerated in order to support future production and mining flexibility. The underground mined grade improved due to higher grade stopes becoming available, aided by additional development capacity.

The instability of the grid power supply weighed on performance during Q3 2020, and this remained an ongoing issue during Q4 2020, albeit with a lesser impact than seen in the prior quarter. Completion of the Genser gas turbine power station was a focus for the site team during Q4 2020. The construction phase was completed during Q4 2020 and commissioning was successfully achieved earlier this quarter, removing the reliance on grid power and providing the operation with a stable supply at an attractive power cost.

Gold production from Wassa was 40.9koz in Q4 2020, in line with production in Q3 2020, despite lower mining volumes, as a result of improved grades from underground mining. FY 2020 production totaled 167.6koz, 7% higher than the 156.2koz realized in FY 2019 as a result of increased mining rates and the introduction of the processing of low grade stockpiles.

Recovery

The recovery was 94.6% for Q4 2020. It remained consistent throughout the year, averaging 94.9% for FY 2020. This is in line with the performance in FY 2019, despite the 12% reduction in the processed ore grade as a result of the decision to process the low-grade stockpiles.

Wassa Underground

Wassa Underground produced 38.4koz of gold (approximately 94% of Wassa’s total production) in the fourth quarter of 2020 and 160.4koz during FY 2020. FY 2020 was characterized by higher mining volumes, resulting in a 5% increase in production relative to the 152.9koz produced in FY 2019. Wassa Underground mining rates have now exceeded 4,000tpd for six consecutive quarters, averaging 4,175tpd in Q4 2020, and 4,469tpd for FY 2020, 15% higher than the 3,895tpd achieved in FY 2019. During the year, the underground mining rate peaked at 4,960tpd during Q3 2020, demonstrating that the decline is capable of operating at approximately 5,000tpd and could deliver higher volumes once the trucking fleet is replaced by 60 tonne trucks as the existing 40 tonne trucks reach the end of their operational life in the coming years.

The mining rate was reduced during Q4 2020 from the record levels seen in Q3 2020 as the underground grade increased to 3.38g/t, and focus was placed on investment in capitalized development. The 20% increase in the grade relative to Q3 2020 is attributable to higher grade stopes becoming available, aided by the return of the expatriate jumbo operators to site during the quarter which resulted in an increase in development rates. During FY 2020, the underground grade averaged 3.13g/t.

Wassa Main Pit/Stockpiles

Given the prevailing gold price environment, the Wassa management team identified the opportunity to process low-grade stockpiles without materially impacting the recovery. Low-grade stockpiles from the historical Wassa Main Pit were therefore blended with the Wassa Underground ore from April 2020. During Q4 2020, a total of 110,246 tonnes processed at an average grade of 0.67g/t which yielded 2.6koz of gold. During FY 2020, a total of 348,235 tonnes of stockpiles were processed at an average grade of 0.65g/t to produce 7.3koz of gold. The processing of these stockpiles will continue throughout 2021 should the current gold price environment sustain.

Unit costs

The unit cost performance remained robust during FY 2020. The mining unit cost of $31/t of ore mined was 9% lower than in FY 2019 as a result of higher ore volumes. This also benefited processing costs which totaled $19/t of ore processed, 11% lower than the $21/t achieved in FY 2019.

Costs per ounce

Cost of sales per ounce increased 9% to $884/oz in FY 2020 due to higher mine operating expenses driven by increased mining and processing volumes and increased labor costs, increased royalties and higher depreciation cost partly offset by higher ounces of gold sold.

Cash operating cost per ounce increased slightly to $653 in 2020 compared to $633 in 2019 due to increased mine operating expenses partly offset by the increased ounces sold base as the benefit of the higher production volumes were offset by increased mining and processing costs driven by higher run rates at lower grades and higher general and administrative costs.

AISC per ounce increased 7% to $1,003 in 2020 compared to 2019 due to a combination of:

- Increased royalties resulting from the higher prevailing gold price;

- Increased corporate general and administrative costs. Following the sale of Bogoso-Prestea and the introduction of the discontinued operations accounting treatment, Wassa is now carrying the full allocation of corporate general and administrative costs and prior periods have been restated on the same basis;

- Increased mine operating expenses as a function of higher mining and processing volumes and higher labor costs;

- Higher sustaining capital expenditure which was in part offset by higher gold sales.

Projects update

In order to equip the mine for its future as a long life operation a number of projects were progressed in FY 2020. These projects included the following initiatives:

- Paste fill plant project update. The paste fill plant project at Wassa continued to progress in Q4 2020 reaching construction completion by the end of the quarter. Commissioning and set up of underground infrastructure, reticulation system, dump valve and shotcreting equipment (including batch plant) is expected to occur through Q1 2021, following a slight delay due to the re-engineering of the filter backwash system during the commissioning phase. The construction of the facility has been delivered below budget and once operational, this project will provide additional flexibility in the mine plan and assist with our intention to increase mining rates in order to further improve the scale and margins at the operation.

- Electrical upgrade. The 11kV surface substation was completed during Q3 2020, as was the single point suspension cable delivering 11kV power to the 620 level underground. This was originally expected to be supervised by electrical engineers coming from Australia, however this work was completed by local contractors with remote support due to Covid-19 related travel restrictions. This is a significant infrastructure project which is intended to support the mine plan for the next five years.

Capital expenditures

Capital expenditures for FY 2020 totaled $45.2m compared to $60.1m during FY 2019. The Wassa management team continued to focus efforts on critical development spend in order to support the medium-term development of the underground operation including:

- Sustaining capital included $14.1m on capitalized underground development activities, $3.2 million on mobile equipment and $3m on capital spare replacements

- Expansion capital included $12.1m on the paste fill plant project, $3.5m in relation to long term capitalized underground development and $1.5m capitalized exploration drilling

EXPLORATION

Exploration activity during FY 2020 was limited by the impact of the COVID-19 pandemic. In response to the pandemic, the Company scaled back field exploration activities from March 2020. Following that decision. the exploration activities focussed on the delineation and refinement of exploration targets across the Company’s tenement package with the compilation and continued review of historic surface geochemical and drilling information, as well as, the updating of geological and geophysical interpretations, and the design of future field-based follow-up programs.

Field work resumed in the third quarter and activities were further ramped up during Q4 2020. Work during the period included further soil sampling on regional targets and surface drilling at Wassa testing up-dip and down-dip extensions of mineralization. Exploration expenditures for Q4 2020 were $2.2 million of which $1.1m was expensed and $1.1m was capitalized. For the year ended December 31, 2020, exploration expenditure amounted to $4.2m of which $2.7m was expensed and $1.5m was capitalized.

Wassa Drilling – Q4 2020

During Q4 2020 a total of five holes were drilled (totaling 3,417 meters) to test for the extension of mineralization above and below the existing underground mining areas. Four holes tested the potential for up-dip extensions of mineralization and one hole tested for the extension of the Hanging wall (“HW”) zone and the down-dip extension of the B-Shoot.

Table 6: Q4 2020 Exploration Drilling Results Identify Extensions of the Wassa Underground Mineralization

|

Hole ID |

Azimuth |

Dip |

From (m) |

To (m) |

Drilled Width |

Estimated |

Grade Au |

Drilling target |

|

BSDD20-001 |

87.4 |

-52.8 |

236.1 |

240.1 |

4.0 |

3.6 |

5.7 |

Up-dip |

|

BSDD20-002 |

No Significant Intersections |

Up-dip |

||||||

|

BSDD20-003 |

92.8 |

-55.6 |

442.0 |

465.8 |

23.8 |

20.9 |

6.9 |

Up-dip |

|

BSDD20-004 |

91.2 |

-50.9 |

369.0 |

376.0 |

7.0 |

6.4 |

5.4 |

Up-dip |

|

BSDD20-005M |

91.8 |

-56.2 |

655.4 |

659.4 |

4.0 |

3.5 |

2.4 |

Down-dip HW |

|

BSDD20-005M |

91.8 |

-56.2 |

669.0 |

673.8 |

4.8 |

4.2 |

4.7 |

Down-dip HW |

|

BSDD20-005M |

90.9 |

-57.3 |

781.7 |

802.7 |

21.0 |

18.1 |

3.6 |

Down-dip |

|

BSDD20-005M |

88.7 |

-57.4 |

815.0 |

823.0 |

8.0 |

6.9 |

1.8 |

Down-dip |

|

BSDD20-005M |

85.4 |

-58.6 |

928.0 |

931.0 |

3.0 |

2.6 |

1.7 |

Down-Dip FW |

|

BSDD20-005M |

81.1 |

-59.5 |

1045.1 |

1054.0 |

8.9 |

7.5 |

3.3 |

Down-dip FW |

These gold intercepts demonstrate the potential to increase the size of the Wassa ore body with extensions to the main B-Shoot, the HW zone and a new foot wall (“FW”) target. These newly identified zones are all within 200 meters of existing mining infrastructure and planned development which is positive from both a cost to access as well as timing perspective:

- BSDD20-001 (up-dip) targeted mineralization below historical open pits and intersected 3.6m at 5.7g/t. This narrow zone of mineralization sits approximately 300m up-dip of the known mineralized zones, within 150m of surface. Further follow up drilling (shown on the section above) is planned to test the extents of this mineralization down-dip towards the deeper B-Shoot horizon which remains open up-dip between these two intercepts.

- BSDD20-003 (up-dip) intersected 20.9m at 6.9g/t and successfully demonstrated a potential extension of the B-Shoot structure 125m up-dip of the last hole drilled on this fence (BSDD19-407 intersected 6.2m at 6.8g/t). This zone was closed off 150m up-dip with hole BSDD20-002 which intersected altered diorite and no significant mineralization.

- BSDD20-004 (up-dip) intersected 6.4m at 5.4g/t in a newly defined foot wall zone. Further drilling is required to determine the extent of this new mineralized zone.

- BSDD20-005 (down-dip) tested two zones of mineralization by targeting (i) an extension of the hanging wall zone that has previously been mined and (ii) the down-dip extension of B-Shoot.

- Hanging wall target – This hole intersected 4.2m at 4.7g/t and 3.5m at 2.4g/t in an area that extends the strike length of this zone by 75m south and 100m down-dip where previous drilling intersected 13.5m grading 3.4 g/t in hole BSDD293.

- Down-dip B Shoot extension target – This hole was also successful in extending the B-Shoot mineralization below the current planned stoping area, where an 18m zone grading 3.6g/t was intersected 65m below hole BSDD293 which intersected 35.6m grading 3.1g/t. This hole also intersected a 7.5m foot wall zone at depth, grading 3.3g/t. Further work on these targets is already underway and a wedge has been set with a daughter hole being drilled to test the zone c.100m down-dip where it remains open.

FINANCIAL PERFORMANCE SUMMARY

Please see the separate financial statements and management’s discussion and analysis for the detailed discussion on the financial results for the three and twelve months Ended December 31, 2020. The following summary focuses on FY 2020 performance.

Financial Performance – Continuing operations

Gold revenue totaled $272.5m in FY 2020, 34% higher than the $203.8m achieved in FY 2019. Relative to FY 2019, FY 2020 benefited from a 7% increase in gold ounces sold and an average realized gold price for spot sales of $1,770/oz (27% higher than in FY 2019). The 25% increase in the average realized gold price of $1,626/oz, relative to FY 2019, was in part offset by the lower average realized price of $393/oz achieved in relation to the RG Streaming Agreement compared to $552/oz in 2019. The realized price related to the streaming agreement with Royal Gold (as amended and restated on September 30, 2020 (the “RG Stream”) was impacted by a negative non-cash adjustment of $8m (2019 – $5.6m) in relation to the deferred revenue liability following updates associated with the latest long-term mine plans.

Non-cash adjustment to revenue. The non-cash deferred revenue adjustment relates to the RG Stream. As the RG Stream contains a variable component, each time there is a significant change to the underlying total expected gold production of Wassa a cumulative catch-up adjustment to the revenue is required.

Cost of sales from continuing operations (excluding depreciation and amortization) totaled $124.4m in FY 2020 compared to $110.1m in FY 2019. Mine operating expenses of $107.4m increased by $8.7m compared to FY 2019 primarily due to:

- Additional reagent, drilling and plant consumables costs in line with increased mining and processing volumes.

- Increased labor costs.

- Higher maintenance costs as a function of higher production rates and larger fixed and mobile capital base.

- Increased site general and administrative costs associated with mining license fees, insurance and gold transportation.

- Royalties increased by $4m in line with the higher revenue base.

Corporate general and administrative expense in FY 2020 amounted to $18.7m, a 28% increase compared to $14.7m in FY 2019 due to costs incurred as part of the relocation of the corporate office, increased insurance expenditure and increased labor costs.

Hedging – The Company originally established the hedging program over 50koz with a floor price of $1,400/oz and a ceiling price of $1,750/oz to provide gold price protection for the forecast production from the Prestea mine over a 12 month period commencing in August 2019. In February 2020, the hedging program was extended to cover the production from Prestea through to the end of 2020. The Company entered into zero cost collars on an additional 12.6koz with a floor price of $1,500/oz and a ceiling price of $1,992/oz. These positions matured at a rate of 4.2koz per month from October to December 2020.

During FY 2020, a number of the original hedge contracts matured with the gold price exceeding the ceiling price at a realized loss of $2.5m. There were no realized losses associated with the contracts during Q4 2020, however, the Company recognized an unrealized loss of $2.1m during the quarter ($2.2m for FY 2020).

As a condition of amending the Macquarie Credit Facility on October 8, 2020, the Company extended its gold price protection hedging program into 2021 and 2022 by entering into zero cost collars with Macquarie Bank Limited on a total of an additional 87.5koz with a floor price of $1,600/oz and a ceiling price of $2,176/oz in 2021 and a ceiling price of $2,188/oz in 2022. These additional positions will mature at a rate of 10.9koz per quarter from March 2021 to December 2022. These are the only hedge contracts that are currently in place for 2021 and 2022, with all prior contracts now expired.

Table 7 – Adjusted EBITDA and Earnings Per Share (from continuing operations):

|

1. See “Non-GAAP Financial Measures” |

Q4 2020 |

Q4 2019 |

FY 2020 |

FY 2019 |

||

|

EBITDA (continuing operations)1 |

$m |

28.5 |

9.5 |

119.6 |

59.2 |

|

|

Adjustments |

||||||

|

(Gain)/loss on fair value of financial instruments |

$m |

(2.2) |

3.0 |

(0.8) |

1.6 |

|

|

Other expense |

$m |

2.2 |

7.9 |

4.8 |

11.9 |

|

|

Variable component adjustment on revenue |

$m |

8.0 |

5.6 |

8.0 |

5.6 |

|

|

Total Adjustments |

$m |

8.0 |

16.5 |

12.0 |

19.1 |

|

|

Adjusted EBITDA (continuing operations)1 |

$m |

36.5 |

26.0 |

131.6 |

78.3 |

|

|

Adjusted EBITDA (discontinued operations)1 |

$m |

– |

(4.6) |

(10.0) |

(13.0) |

|

|

Total adjusted EBITDA (inc. discontinued operations)1 |

$m |

36.5 |

21.4 |

121.7 |

65.4 |

|

|

Net income/(loss) attributable to shareholders (continuing operations) |

$m |

8.2 |

(1.2) |

38.5 |

5.3 |

|

|

Net income/(loss) attributable to shareholders per share (continuing operations) |

$/share |

0.07 |

(0.01) |

0.35 |

0.05 |

|

|

Net income/(loss) attributable to shareholders (inc. discontinued operations) |

$m |

6.5 |

(62.4) |

(52.1) |

(67.4) |

|

|

Net income/(loss) attributable to shareholders per share (inc. discontinued operations) |

$/share |

0.06 |

(0.57) |

(0.47) |

(0.62) |

|

|

Adjusted net income attributable to shareholders (continuing operations)1 |

$m |

12.7 |

8.0 |

44.6 |

17.5 |

|

|

Adjusted net income attributable to shareholders (continuing operations) per share1 |

$/share |

0.11 |

0.07 |

0.40 |

0.16 |

EBITDA from continuing operations amounted to $119.6m for FY 2020, more than double the $59.2m achieved in FY 2019. Once adjusted for the loss/gain on fair value of financial instruments and other expenses, the Company generated an Adjusted EBITDA from continuing operations of $131.6m for FY 2020, an increase of 68% compared to FY 2019. These increases are due to the significant improvement in mine operating profits following from higher gold sales and improved realized gold prices. Adjusted EBITDA margin (see “Non-GAAP Financial Measures”) compared favorably at 48% for FY 2020 (FY 2019 – 38%).

Net income from continuing operations attributable to Golden Star shareholders for FY 2020 totaled $38.5m or $0.35 income per share (basic), compared to a net income of $5.3m or $0.05 basic income per share in 2019. The improved performance reflects the impact of the higher revenues and lower other expenditure incurred that was in part offset by resulting increased income taxes, higher corporate general and administrative expenses and increased finance expenses.

Adjusted net income attributable to Golden Star shareholders (see “Non-GAAP Financial Measures” section) was $44.6m or $0.40 basic income per share in 2020 compared to $17.5m or $0.16 basic income per share in 2019. Adjusted net income attributable to Golden Star shareholders reflects adjustments for non-recurring and abnormal items which are mostly non-cash in nature. The increase during FY 2020 compared to FY 2019 was primarily due to the higher mine operating profit on the back of improved sales volumes and gold prices partly offset by the resulting increased income tax expense.

Net Cash Flow and Financial position

The table below summarizes the uses of cash in Q4 2020 and FY 2020 and the resulting impact on the financial position of the Company:

Table 8 – Cash Flow and Net Debt Position

|

Q4 2020 |

Q4 2019 |

FY 2020 |

FY 2019 |

|||

|

Net cash from (used in) continuing operations |

||||||

|

Operating activities (inc. working capital) |

$m |

19.4 |

19.2 |

84.0 |

50.1 |

|

|

Investing activities |

$m |

(13.5) |

(22.9) |

(47.2) |

(56.5) |

|

|

Financing activities |

$m |

8.6 |

8.0 |

2.0 |

1.5 |

|

|

Increase/(decrease) in cash from continuing operations |

$m |

14.5 |

4.3 |

38.8 |

(4.9) |

|

|

Net cash from (used in) discontinued operations |

||||||

|

Operating activities (inc. working capital) |

$m |

(1.9) |

(6.0) |

(23.9) |

(27.3) |

|

|

Investing activities |

$m |

– |

(2.3) |

(7.5) |

(10.9) |

|

|

Financing activities |

$m |

– |

0.6 |

– |

– |

|

|

Decrease in cash from discontinued operations |

$m |

(1.9) |

(7.7) |

(31.4) |

(38.2) |

|

|

Cash position at start of period |

$m |

48.3 |

56.8 |

53.4 |

96.5 |

|

|

Cash position at period end |

$m |

60.8 |

53.4 |

60.8 |

53.4 |

|

|

Summary of debt facilities |

||||||

|

Macquarie credit facility |

$m |

54.5 |

57.4 |

54.5 |

57.4 |

|

|

Convertible debentures |

$m |

49.7 |

47.0 |

49.7 |

47.0 |

|

|

Finance leases |

$m |

1.5 |

2.4 |

1.5 |

2.4 |

|

|

Gross Debt Position |

$m |

105.7 |

106.8 |

105.7 |

106.8 |

|

|

Net Debt Position |

$m |

45.0 |

53.4 |

45.0 |

53.4 |

Financial position – The Company held $60.8m of cash and cash equivalents and $105.7m of debt, for net debt of $44.9m as at December 31, 2020. The net debt position improved by $8.5m during FY 2020 as a result of the $7.4m increase in the cash position.

Free cash flow – During FY 2020 continuing operations provided cash of $36.8m, a $43.1m increase from the $6.4m of negative free cash flow from continuing operations in FY 2019. This is attributable to higher gold production, an increase in the realized gold price and lower capital expenditure.

Company Profile:

Golden Star is an established gold mining company that owns and operates the Wassa underground mine in Ghana, West Africa. Listed on the NYSE American, the Toronto Stock Exchange and the Ghanaian Stock Exchange, Golden Star is focused on delivering strong margins and free cash flow from the Wassa mine. As the winner of the Prospectors & Developers Association of Canada 2018 Environmental and Social Responsibility Award, Golden Star remains committed to leaving a positive and sustainable legacy in its areas of operation

Statements Regarding Forward-Looking Information

Some statements contained in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and “forward looking information” within the meaning of Canadian securities laws. Forward looking statements and information include but are not limited to, statements and information regarding: present and future business strategies and the environment in which Golden Star will operate in the future, including the price of gold, anticipated costs and ability to achieve goals; gold production, cash operating costs, AISC and capital expenditure estimates and guidance for 2021, and the Company’s achievement thereof; the sources of gold production at Wassa during 2021; the processing of low grade stockpiles at Wassa for the remainder of the year; expected grade and mining rates for 2021; the ability to improve recovery; the ability to achieve production growth; the ability to improve cash generation; the ability to increase the size of the Wassa ore body; the commissioning of the paste fill plant project and timing thereof; the improvements to be realized through the delivery of a range of operational initiatives; the ability to improve the scale of operations and margin at Wassa; the expected allocation of the Company’s capital expenditures; implementation of the Company’s exploration programs and the timing thereof; the anticipated exploration activities for 2021; the ability to expand the Company and its production profile through exploration and development activities; the potential impact of the COVID-19 pandemic on the Company’s operations and the ability to mitigate such impact; the securing of adequate supply chains for key consumables; the ability to continue to ship gold across borders and to refine doré at the South African refinery; the receipt by Golden Star of the deferred consideration from the sale of Bogoso-Prestea, and the potential amount and timing thereof; the anticipated effectiveness of the hedging program over the next 12 months; and the Company having sufficient cash available to support its operations and mandatory expenditures for the next twelve monthsGenerally, forward-looking information and statements can be identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations of such words and phrases (including negative or grammatical variations) or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Investors are cautioned that forward-looking statements and information are inherently uncertain and involve risks, assumptions and uncertainties that could cause actual facts to differ materially. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Golden Star will operate in the future. Forward-looking information and statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of Golden Star to be materially different from those expressed or implied by such forward-looking information and statements, including but not limited to: gold price volatility; discrepancies between actual and estimated production; mineral reserves and resources and metallurgical recoveries; mining operational and development risks; liquidity risks; suppliers suspending or denying delivery of products or services; regulatory restrictions (including environmental regulatory restrictions and liability); actions by governmental authorities; the speculative nature of gold exploration; ore type; the global economic climate; share price volatility; the availability of capital on reasonable terms or at all; risks related to international operations, including economic and political instability in foreign jurisdictions in which Golden Star operates; risks related to current global financial conditions; actual results of current exploration activities; environmental risks; future prices of gold; possible variations in mineral reserves and mineral resources, grade or recovery rates; mine development and operating risks; an inability to obtain power for operations on favourable terms or at all; mining plant or equipment breakdowns or failures; an inability to obtain products or services for operations or mine development from vendors and suppliers on reasonable terms, including pricing, or at all; public health pandemics such as COVID-19, including risks associated with reliance on suppliers, the cost, scheduling and timing of gold shipments, uncertainties relating to its ultimate spread, severity and duration, and related adverse effects on the global economy and financial markets; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; litigation risks; and risks related to indebtedness and the service of such indebtedness. Although Golden Star has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that future developments affecting the Company will be those anticipated by management. Please refer to the discussion of these and other factors in management’s discussion and analysis of financial conditions and results of operations for the year ended December 31, 2020, and in our annual information form for the year ended December 31, 2019 as filed on SEDAR at www.sedar.com. The forecasts contained in this press release constitute management’s current estimates, as of the date of this press release, with respect to the matters covered thereby. We expect that these estimates will change as new information is received. While we may elect to update these estimates at any time, we do not undertake any estimate at any particular time or in response to any particular event.

Non-GAAP Financial Measures

In this press release, we use the terms “cash operating cost”, “cash operating cost per ounce”, “all-in sustaining costs”, “all-in sustaining costs per ounce”, “adjusted net (loss)/income attributable to Golden Star shareholders”, “adjusted (loss)/income per share attributable to Golden Star shareholders”, “cash provided by operations before working capital changes”, and “cash provided by operations before working capital changes per share – basic”.

“Cost of sales excluding depreciation and amortization” as found in the statements of operations includes all mine-site operating costs, including the costs of mining, ore processing, maintenance, work-in-process inventory changes, mine-site overhead as well as production taxes, royalties, severance charges and by-product credits, but excludes exploration costs, property holding costs, corporate office general and administrative expenses, foreign currency gains and losses, gains and losses on asset sales, interest expense, gains and losses on derivatives, gains and losses on investments and income tax expense/benefit.

“Cost of sales per ounce” is equal to cost of sales excluding depreciation and amortization for the period plus depreciation and amortization for the period divided by the number of ounces of gold sold (excluding pre-commercial production ounces sold) during the period.

“Cash operating cost” for a period is equal to “cost of sales excluding depreciation and amortization” for the period less royalties, the cash component of metals inventory net realizable value adjustments, materials and supplies write-off and severance charges, and “cash operating cost per ounce” is that amount divided by the number of ounces of gold sold (excluding pre-commercial production ounces sold) during the period. We use cash operating cost per ounce as a key operating metric. We monitor this measure monthly, comparing each month’s values to prior periods’ values to detect trends that may indicate increases or decreases in operating efficiencies. We provide this measure to investors to allow them to also monitor operational efficiencies of the Company’s mines. We calculate this measure for both individual operating units and on a consolidated basis. Since cash operating costs do not incorporate revenues, changes in working capital or non-operating cash costs, they are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Changes in numerous factors including, but not limited to, mining rates, milling rates, ore grade, gold recovery, costs of labor, consumables and mine site general and administrative activities can cause these measures to increase or decrease. We believe that these measures are similar to the measures of other gold mining companies, but may not be comparable to similarly titled measures in every instance.

“All-in sustaining costs” commences with cash operating costs and then adds the cash component of metals inventory net realizable value adjustments, royalties, sustaining capital expenditures, corporate general and administrative costs (excluding share-based compensation expenses and severance charges), and accretion of rehabilitation provision. For mine site all-in sustaining costs, corporate general and administrative costs (excluding share-based compensation expenses and severance charges) are allocated based on gold sold by each operation. “All-in sustaining costs per ounce” is that amount divided by the number of ounces of gold sold (excluding pre-commercial production ounces sold) during the period. This measure seeks to represent the total costs of producing gold from current operations, and therefore it does not include capital expenditures attributable to projects or mine expansions, exploration and evaluation costs attributable to growth projects, income tax payments, interest costs or dividend payments. Consequently, this measure is not representative of all of the Company’s cash expenditures. In addition, the calculation of all-in sustaining costs does not include depreciation expense as it does not reflect the impact of expenditures incurred in prior periods. Therefore, it is not indicative of the Company’s overall profitability. Share-based compensation expenses are also excluded from the calculation of all-in sustaining costs as the Company believes that such expenses may not be representative of the actual payout on equity and liability based awards.

The Company believes that “all-in sustaining costs” will better meet the needs of analysts, investors and other stakeholders of the Company in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing the operating performance and the Company’s ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. Due to the capital intensive nature of the industry and the long useful lives over which these items are depreciated, there can be a disconnect between net earnings calculated in accordance with IFRS and the amount of free cash flow that is being generated by a mine. In the current market environment for gold mining equities, many investors and analysts are more focused on the ability of gold mining companies to generate free cash flow from current operations, and consequently the Company believes these measures are useful non-IFRS operating metrics (“non-GAAP measures”) and supplement the IFRS disclosures made by the Company. These measures are not representative of all of Golden Star’s cash expenditures as they do not include income tax payments or interest costs. Non-GAAP measures are intended to provide additional information only and do not have standardized definitions under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS.

“Adjusted net (loss)/income attributable to Golden Star shareholders” is calculated by adjusting net (loss)/income attributable to Golden Star shareholders for (gain)/loss on fair value of financial instruments, share-based compensation expenses, severance charges, loss/(gain) on change in asset retirement obligations, deferred income tax expense, non-cash cumulative adjustment to revenue and finance costs related to the Streaming Agreement, and impairment. The Company has excluded the non-cash cumulative adjustment to revenue from adjusted net income/(loss) as the amount is non-recurring, the amount is non-cash in nature and management does not include the amount when reviewing and assessing the performance of the operations. “Adjusted (loss)/income per share attributable to Golden Star shareholders” for the period is “Adjusted net (loss)/income attributable to Golden Star shareholders” divided by the weighted average number of shares outstanding using the basic method of earnings per share.

For additional information regarding the Non-GAAP financial measures used by the Company, please refer to the heading “Non-GAAP Financial Measures” in the Company’s Management Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2019 and the three months ended March 31, 2020, which are available at www.sedar.com.

This News Was Shared To Prittle Prattle News Via A Press Release

Published by Prnewswire

Published by Prnewswire

Also Read: Ryan Ding 5G Lighting